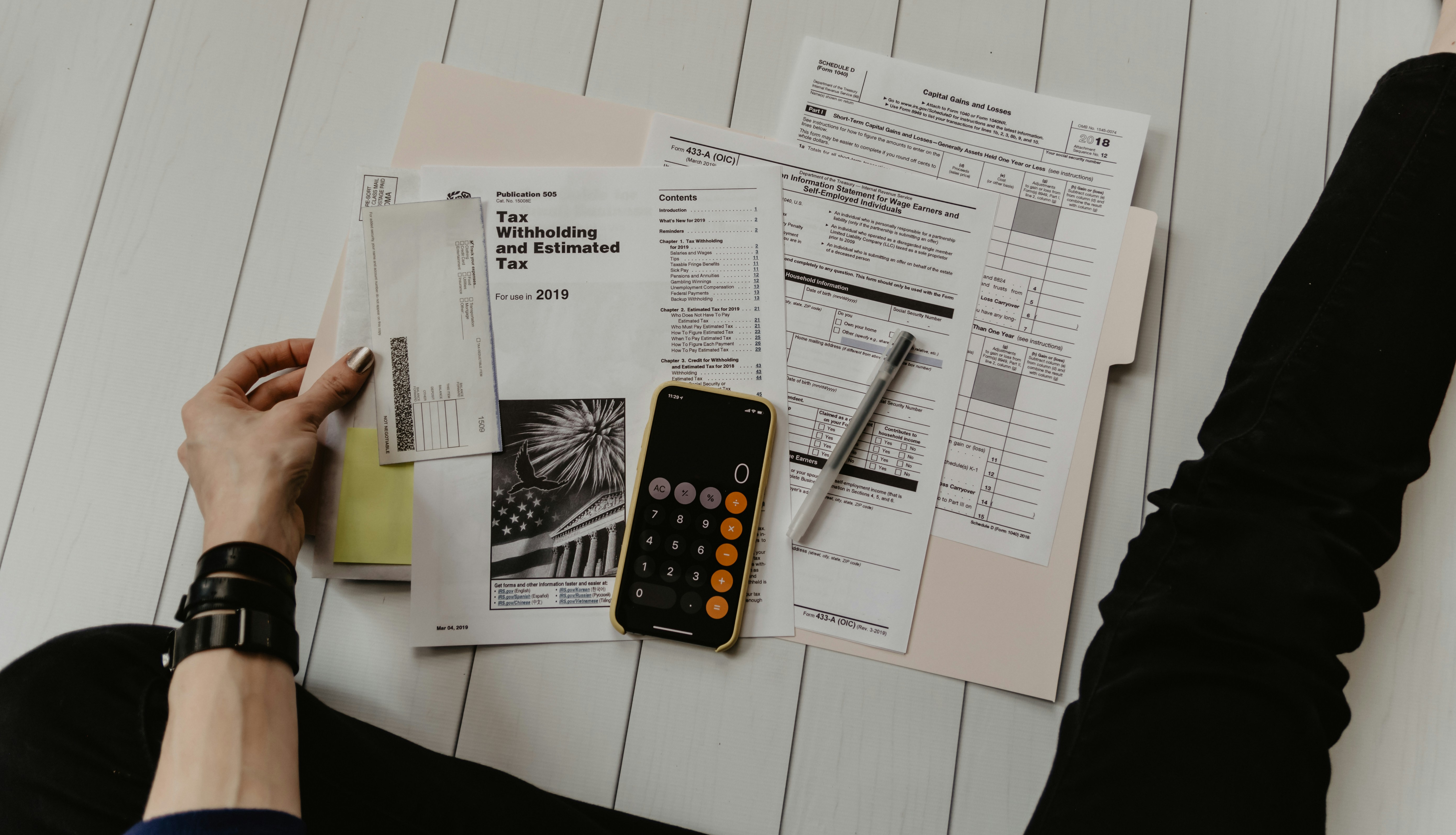

Expert Tax Solutions for Your Peace of Mind

Claim Your Complimentary Tax Consultation

Click below to claim your offer. We'll then reach out to answer any questions you may have.

CBrown & Associates - NC

At CBrown & Associates - NC, we are dedicated tax specialists committed to simplifying your tax experience. With years of expertise, we offer personalized services including tax preparation, audit support, strategic planning, and extensions. Our goal is to provide accurate, reliable, and comprehensive tax solutions tailored to meet your unique needs. Trust us to handle your taxes with professionalism and care, ensuring your financial well-being every step of the way. Your success is our priority.

WHY CHOOSE US

personalized advice from experienced tax professionals

Precise and timely tax preparation, minimizing errors and delays

comprehensive audit representation services

tailored tax planning strategies

seamless tax extension services

Frequently Asked Questions

What services do you offer?

We provide a range of services including tax preparation, audit support, strategic tax planning, and tax extensions to meet all your tax-related needs.

How do you ensure the accuracy of my tax return?

Our experienced team follows a meticulous process, double-checking every detail and staying up-to-date with the latest tax laws to ensure your tax return is accurate and compliant.

What should I do if I receive an audit notice?

If you receive an audit notice, contact us immediately. We will guide you through the process, represent you during the audit, and work to resolve any issues that arise.

How can tax planning benefit me?

Strategic tax planning helps you make informed financial decisions, reduce your tax liability, and maximize savings by utilizing available deductions, credits, and planning strategies.

Can you help me file for a tax extension?

Yes, we offer hassle-free tax extension services to help you meet IRS deadlines and avoid penalties, giving you additional time to prepare your tax return accurately.

What documents do I need for tax preparation?

You will need various documents such as W-2s, 1099s, receipts for deductible expenses, mortgage interest statements, and records of other income or investments. Bringing your previous year's tax return is also helpful.

Testimonials

Anthony McMurray

They always are timely & deliver on what’s promised I recommend them to plenty on my business partners always a pleasant experience.

Elaine Workman

The team is reliable, professional, and consistently exceeds expectations. Their exceptional service makes them my go-to recommendation for colleagues.

Saleena Gilliard

I’m extremely satisfied with C.Brown & Associates’ service since switching. Dwayne is professional, efficient, and ensures thorough tax understanding. Highly recommended!.

Shop: 150 Andrews Rd STE 5A PMB 35, Fayetteville NC 28311

Call (910) 745-6960

Email: [email protected]

Site: www.cbrowntaxes.com